Why the Significance of Risk Management Can not Be Overlooked in Today's Economic climate

In today's quickly evolving economic landscape, the role of Risk Management has ended up being essential. This increases a critical question: can the significance of Risk Management in making sure security and sustainability be forgotten?

Recognizing the Principle of Risk Management

The Function of Risk Management in Today's Economic climate

Having understood the principle of Risk Management, we can currently discover its duty in today's economic situation. In the context of an uncertain financial landscape marked by rapid technological modifications and international events, Risk Management becomes a necessary strategic part, adding to the stability, sustainability, and overall strength of economies on both a macro and mini range.

The Effect of Disregarding Risk Management

Neglecting Risk Management can result in alarming consequences for any company or economy. When prospective dangers are not identified, assessed, and alleviated, organizations reveal themselves to unforeseen and typically significant problems. These could show up as monetary losses, reputational damage, operational disruptions, or even lawful problems. Furthermore, in today's unpredictable financial environment, an unexpected dilemma can quickly rise, leaving an ill-prepared company rushing for survival. The international financial dilemma of 2008 functions as a raw tip of the tragic effect that ignoring Risk Management can carry the economic climate at big. Hence, neglecting Risk Management not just threatens individual organizations however can destabilize the entire economic climate, underscoring the crucial function played by efficient Risk Management in today's economic landscape - importance of risk management.

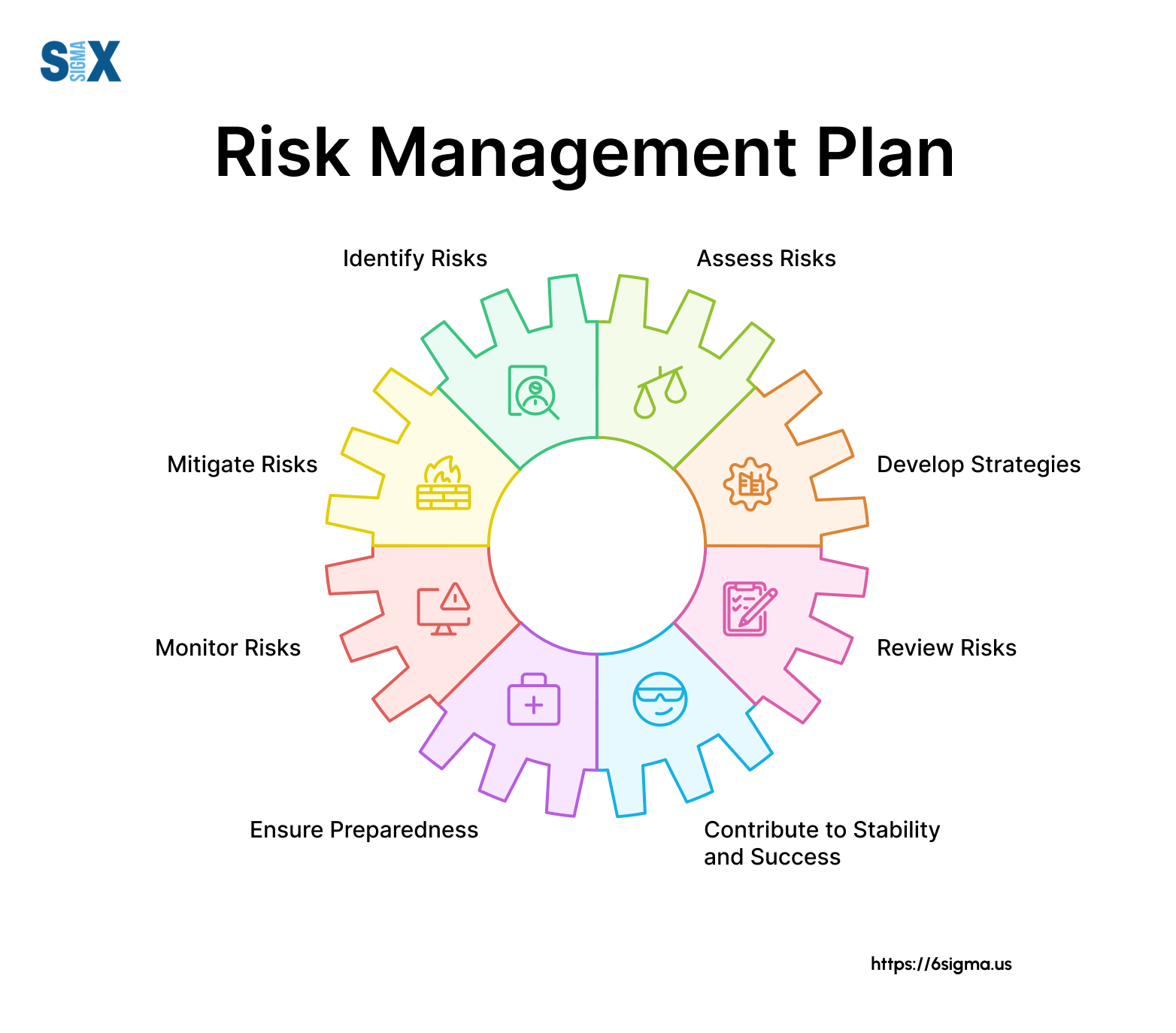

Trick Components of Effective Risk Management Strategies

Efficient Risk Management strategies rotate around 2 crucial parts: identifying potential dangers and carrying out mitigation procedures. To make certain the stability and sustainability of a business, these elements need to not be neglected. In the following conversation, these important facets will be explored in detail.

Identifying Possible Threats

Why is determining possible dangers critical in any kind of Risk Management technique? Identification of potential risks is the cornerstone of any reliable Risk Management method. It involves the systematic examination of business landscape, both inner and exterior, to uncover threats that can thwart a company's strategic purposes. Recognizing prospective risks permits companies to expect problems, as opposed to simply respond to them. This positive technique empowers businesses to take care of unpredictability with self-confidence, by highlighting locations that require more interest and planning. It additionally enables them to prioritize sources effectively, focusing on dangers that might have the most substantial influence on their operations. Overall, the process of recognizing prospective dangers is an important action in promoting business durability and advertising sustainable development.

Implementing Mitigation Measures

Browsing with the volatile organization waters, companies embark on the essential journey of applying reduction actions as part of their Risk Management techniques. These procedures, designed to minimize the influence of potential dangers, form the backbone of a robust Risk Management strategy. They encompass different strategies, consisting of transferring the Risk to an additional celebration, avoiding the Risk, lowering the negative effect or probability of the Risk, or even accepting some you could look here or all the repercussions of a specific Risk. The selection of approach relies on the organization's particular context, Risk resistance, and ability to birth losses. Effective mitigation requires cautious preparation, routine modification, and constant watchfulness. In an unstable click for source economy, these actions increase strength, ensuring long-lasting survival and development.

Case Researches: Successful Risk Management in Technique

In spite of the intricacies entailed, there are numerous circumstances of effective Risk Management in method that show its essential function in organization success. The automaker rapidly developed a danger Management group that decreased production downtime by identifying alternative suppliers. These instances underscore that successful Risk Management can not just shield companies from prospective dangers however likewise enable them to seize opportunities.

Future Trends in Risk Management: Adapting to a Dynamic Economy

Looking in advance, the landscape of Risk Management is positioned for considerable modifications as it adjusts to a vibrant economy. Technical improvements are expected to reinvent the area, with automation and man-made knowledge playing an essential role in Risk identification and mitigation. This change will certainly necessitate a new ability set for Risk managers, that will require to be experienced at making use of these technologies. At the exact same time, the enhancing complexity of global markets and the changability of geopolitical events are making Risk Management much more tough. Consequently, a pattern towards even more integrated, all natural methods to managing dangers that consider a vast array of scenarios is prepared for. importance of risk management. This will be essential in navigating the intricacies of the future financial setting.

Conclusion

In verdict, Risk Management plays a critical role in today's interconnected and volatile economy. As the economy continues you can try this out to advance, so have to take the chance of Management approaches, emphasizing its ongoing importance in an ever-changing company landscape.

An appropriate Risk Management technique is not concerning removing risks entirely - a task nearly impossible in the volatile globe of company. Therefore, overlooking Risk Management not just intimidates specific businesses but can destabilize the entire economic situation, emphasizing the crucial function played by efficient Risk Management in today's financial landscape.

Effective Risk Management strategies rotate around 2 key parts: recognizing prospective risks and implementing mitigation measures.Why is recognizing prospective dangers vital in any type of Risk Management strategy? They incorporate different techniques, consisting of moving the Risk to another party, staying clear of the Risk, lowering the negative result or chance of the Risk, or even accepting some or all the consequences of a certain Risk.

Tony Danza Then & Now!

Tony Danza Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!